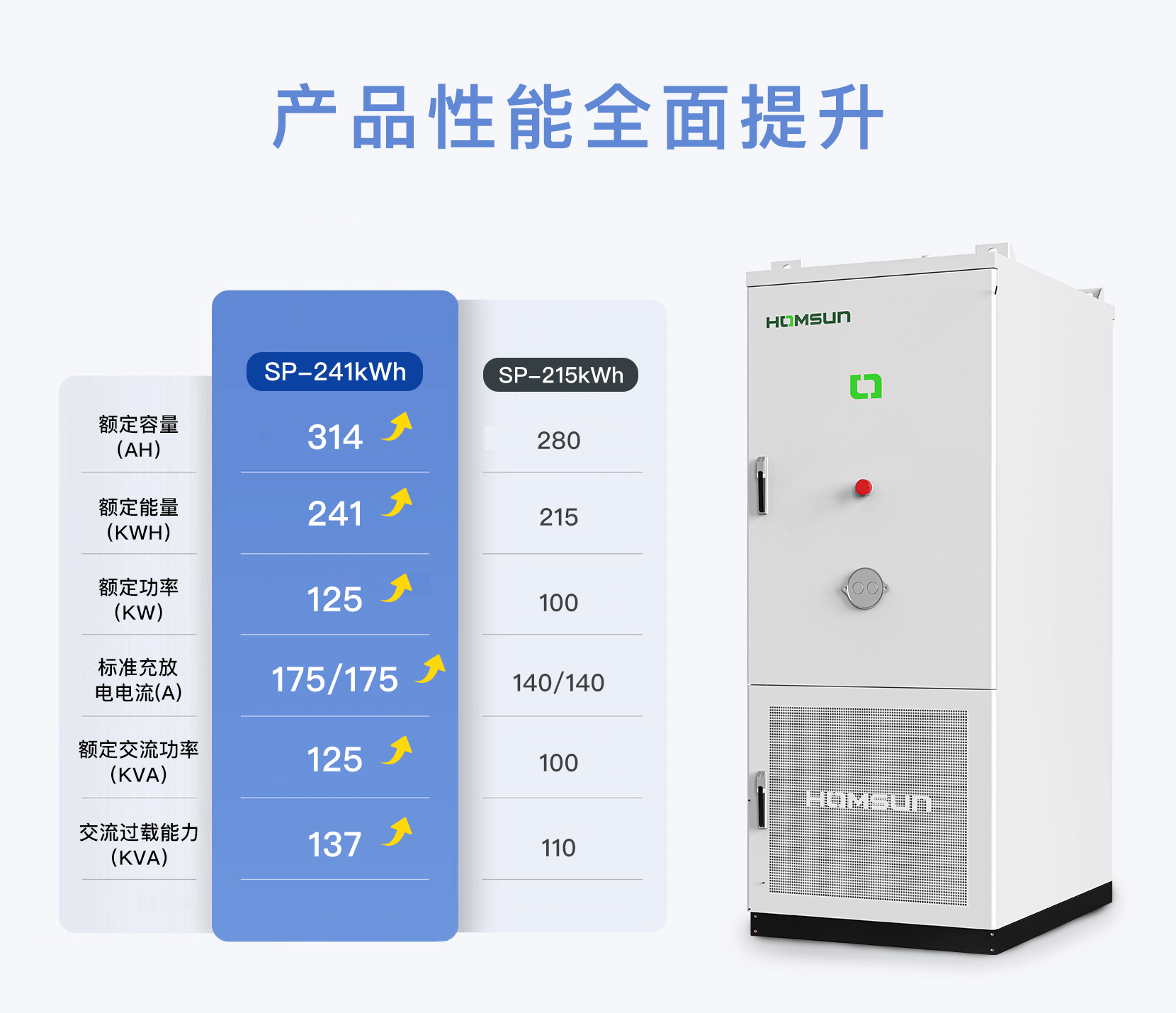

Economic Analysis of Commercial & Industrial Energy Storage and Homsun Energy Storage Solutions

Panoramic Core Profit Models and Pearl River Delta Practices:

As a hub for intelligent manufacturing in the Pearl River Delta, Foshan and surrounding cities exhibit significant peak-valley electricity price differentials , creating inherent advantages for energy storage economics.

Homsun leverages its self-developed C&I energy storage cabinets and integrated solar-storage solutions, combined with Greater Bay Area policy benefits, to establish six revenue closed-loops:

1. Peak-Valley Price Arbitrage | Economic Cornerstone of C&I Energy Storage Cabinets

Model Analysis: "Buy low, sell high" electricity strategy with dual charge-discharge cycles.

Homsun Solution:

• Technical Support: Liquid-cooled cabinets equipped with three-level converters for precise valley charging and peak discharging.

• PRD Advantage: Foshan and Dongguan are key demand-side response cities in Guangdong, where price differentials coupled with local subsidies amplify returns.

2. Energy Time-Shifting Optimization | Value Amplifier for Solar-Storage Integration

Model Analysis: Stabilize PV volatility and enhance green energy self-consumption.

Homsun Practice:

• PV-Storage Synergy: Store excess midday PV generation for afternoon peak discharge.

• Quantified Benefits: Projects reduce electricity costs further, achieving 85% green energy self-consumption.

• Foshan Context: Shunde District’s PV capacity exceeds 400MW; Homsun’s "storage + flexible grid-tie" solution mitigates curtailment.

3. Demand Charge Management | Transformer Upgrade Alternative

Model Analysis: Dynamically regulate power peaks to avoid demand charge overages.

Core Solution:

• Hardware: EMS monitors real-time loads and smooths fluctuations via rapid response.

• Data Validation: One enterprise reduced monthly peak demand by 32%, saving 180k yuan/year in basic fees.

• PRD Pain Points: Transformer upgrades cost 200k yuan/MVA in manufacturing hubs like Guangzhou-Shenzhen-Foshan; storage delays upgrade needs.

4. Demand Response | Policy-Driven Revenue in the PRD

Model Analysis: Earn subsidies by participating in grid peak-shaving.

Homsun Capabilities:

• Subsecond Response: Cabinets achieve grid connection/disconnection within 100ms, meeting Guangdong’s "2-hour fast response" mandate.

• Case Study: A Foshan tech park earned 20k yuan per event through 30 annual peak-shaving events.

• Policy Leverage: Guangdong Virtual Power Plant Implementation Plan offers 0.3 yuan/kWh subsidies, piloted in Financial City and Tanzhou Convention Center.

5. Electricity Spot Trading | VPP Model Breaks Profit Ceilings

Model Analysis: Aggregate storage resources for power market bidding.

Implementation:

• Hardware Foundation: Homsun EMS supports Modbus-TCP for third-party platform integration.

• Revenue Model: A Dongguan industrial park achieved 0.15 yuan/kWh arbitrage via VPP intraday trading.

• Market Potential: 48% price volatility in Southern China’s spot market positions cabinets as premium arbitrage tools.

6. Ancillary Service Compensation | Stabilized Revenue Anchor

Model Analysis: Earn fees via frequency regulation and reserve services.

Technical Assurance:

• Key Specs: ≤200ms response time, ±1% regulation accuracy.

• Commercial Proof: A Zhuhai frequency regulation project boosted annual returns by 19%, lifting IRR to 14.7%.

• Regional Opportunity: Southern Grid compensates 0.5-0.8 yuan/MW for ancillary services, outperforming gas turbines.